Influencing investor sentiment: Do companies communicate differently whether they meet or miss earnings?

Congratulations! Your company beat the consensus estimates this quarter. Should your investor relations team encourage executives to exude confidence when delivering results on the earnings call? Or perhaps you didn’t perform as well as expected, missing estimates instead. How far will confidence get you in increasing investor sentiment when results fall short? Can you salvage the miss by showing optimism about the future?

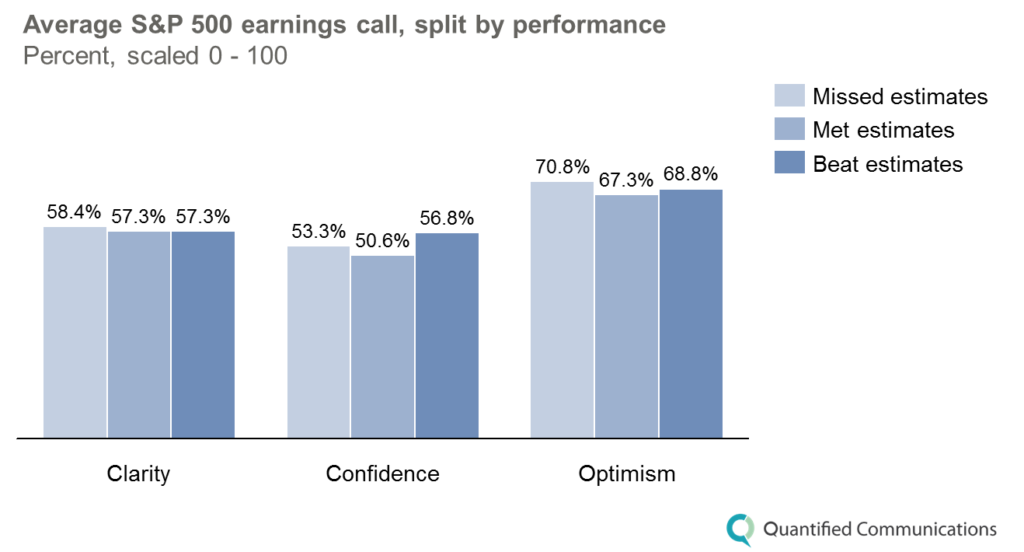

Every company has to create its own strategy for communicating the previous quarter’s results on an earnings call. We wondered whether there is a distinct pattern for how companies communicate when they meet, beat, or miss consensus estimates. Our proprietary communication analytics platform puts us in the unique position of being able to look for communication trends across large sets of data. We put our platform to work, analyzing the language S&P 500 companies used in their earnings calls over four quarters.

We found that in general, companies communicate in the same way whether they miss, meet, or beat analyst estimates.

Should companies frame their message based on the quarter’s performance?

Research suggests that performance relative to estimates affects stock price. Some studies have found that firms with positive earnings surprises show above-average stock performance, while firms with negative surprises show below-average performance. However, that “surprise” effect may be misleading. An article from McKinsey & Company argues that “the promise of meeting or beating consensus estimates and the peril of missing them are profoundly overstated.” One of the main reasons is that investor sentiment is driven by more than the raw data. Investors look for additional information to explain the company’s performance.

This is where the earnings call comes in. During earnings calls, executives have the opportunity to sway investor sentiment not only by reporting on their past performance, but also by providing context for why the numbers came out as they did. Investors will look for information from the market, from analysts, and from the media to fill in the blanks. By taking control of the earnings call, executives can help control the message that investors will ultimately use to make decisions.

Taking advantage of these opportunities to control the message can make all the difference for investor sentiment—and your company’s value in the stock market—regardless of whether you meet, beat, or miss estimates.

More on financial communication measurement and data-driven investor relations from Quantified Communications.

To learn more about how we can help your investor relations team use analytics to improve your financial communications, contact us at info@quantifedcommunications.com.