A data-driven case for CEOs to participate in earnings calls

Our analysis shows why CEOs are the most effective speakers on earnings calls

Earlier this month, Jaime Dimon, JPMorgan Chase’s Chairman and CEO, concluded his remarks on the company’s earnings conference call with some surprising news for investors: going forward, he no longer plans to attend future earnings calls because he did not think it was necessary. Dimon went on to clarify that his decision was not about avoiding bad news but about enabling the company’s CFO, Marianne Lake, to be the voice for investors. Lake, he said, was doing “such a great job that [it has] become unnecessary to be on all of them [earnings calls].” Dimon said that he “can obviously go do other things.” According to CNBC, in choosing to skip his company’s earnings calls, Dimon is keeping with other recent moves made by CEOs of publicly traded companies.

Dimon’s decision, however, could result in unintended consequences. A study from Gotham Research Group of prominent sell-side analysts revealed that when evaluating a company, the impression and opinion of a CEO provides some of the most influential qualitative data available. What’s more, topping the list of CEO actions that raise red flags for analysts was “Failure [for a CEO] to communicate a compelling, thoughtful rationale for strategic decisions.” Another key finding suggests that “CEO’s who don’t demonstrate that they have a full, working understanding of the numbers lack credibility among analysts.”

Data-driven insights for executive earnings call participation

Given the importance of a CEO’s role in influencing analysts through thoughtful communication of both the rationale for strategic decisions and an understanding of the numbers, we wondered if analysis of past earnings calls could help CEOs justify or question their decision to participate on quarterly earnings calls.

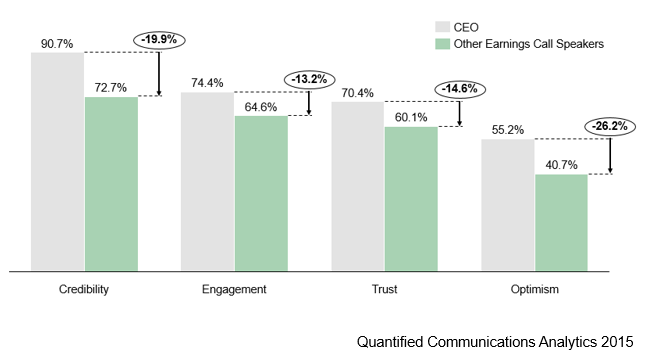

Using our proprietary communication analytics platform, we found that CEOs have a significant and positive communication impact on earnings calls, beating out other earnings call speakers on all key measures of content effectiveness, in particular during their prepared remarks.

Earnings call communication analysis: CEO vs. Other Earnings Call Speakers

While we recognize that the content presented by other earnings call participants tends to be more numbers-oriented than that of a CEO, our analysis suggests that companies should put their best communicators—and storytellers—in the game. We found that on average, CEOs speak with 19.9% more credibility, use 13.2% more engaging language, are 14.6% more trustworthy, and speak with 26.2% more optimism.

Because CEOs offer more explanations and deeper insights into results, they are in a position to increase credibility and build trust with investors and analysts. In the event that a CEO chooses not to participate, other earnings call participants need to step up and communicate beyond the numbers by sharing the company’s investment narrative in the most effective way possible. That means including big-picture details, adding color by providing key insights and using optimistic, trustworthy language to motivate employees, investors and analysts alike.

More on financial communication measurement and data-driven investor relations from Quantified Communications.

To learn more about how we can help your investor relations team use data to improve your financial communications, contact us at info@quantifiedcommunications.com.