Communicating an earnings miss

How to maintain trust with analysts and investors when your company misses estimates

Whether your company is a recent IPO or a sturdy fixture in the S&P 500, shareholders recognize that even healthy companies and strong leadership teams miss estimates. When this happens, the challenge for management is to effectively communicate the factors leading to the miss without losing analysts’ and investors’ trust. Two questions guide the preparation of these communications:

- How can management focus the conversation on how they are addressing the problem?

- How can management preserve their credibility and ensure the company’s long-term valuation?

Our research: How do companies communicate when they miss estimates?

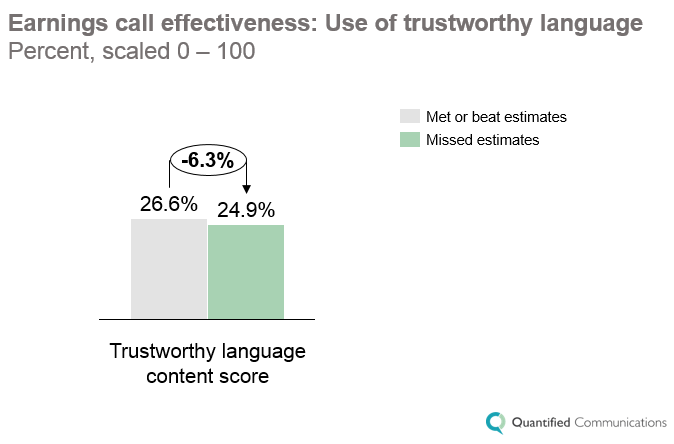

Using our communication analytics platform, we measured nearly 400 earnings calls from Q1 2015 and found that there’s room for improvement when it comes to S&P 500 companies communicating missed estimates. When communicating an earnings miss, these companies used 6.3% less trustworthy language than the average of all S&P 500 companies who met or beat earnings estimates.

External research: Sustaining trust is critical for investors and analysts

Research has suggested communicating in a trustworthy manner is even more important during missed estimates. A recent CFA Institute survey of analysts and investors found that a lack of transparency in financial reporting leads to loss of investor trust and has negative implications on their willingness to invest.

Key insights: Improving the trustworthiness of your financial communications

For executives looking to demonstrate more trust and accountability on earnings calls, our analytics suggest focusing on the following four factors:

- Own the results: To take responsibility for the earnings miss and display ownership of the results, use more first-person pronouns.

- Use more positive language: Negative language can be correlated with guilt about the topic being discussed. In an earnings call setting, it is important to acknowledge what went wrong, and then talk about what you’re doing to correct it, using positive language to show optimism for the future.

- Be transparent: At the same time, don’t try to spin bad news to make it look good. Acknowledge the miss and share specific steps to move forward. According to research conducted by Stanford’s Rock Center for Corporate Governance, deceptive language of CEOs and CFOs on earnings calls creates a 4 – 6 percent increase in likelihood of an earnings restatement. Your shareholders will appreciate your honesty, and the credibility of your management team will remain secure.

- Be prepared: Make sure that all executives with a role in communicating the bad news are aligned on messaging and understand how to customize their talking points to each of the constituents on the call.

To learn more about how we can help your team use analytics to improve your financial communications, contact us at info@quantifiedcommunications.com.

More on financial communication measurement and data-driven investor relations from Quantified Communications.